Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 08 novembro 2024

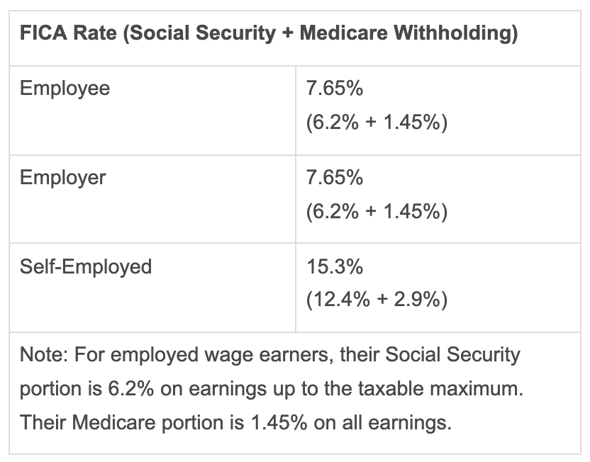

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

2021 Wage Base Rises for Social Security Payroll Taxes

Historical Social Security and FICA Tax Rates for a Family of Four

Payroll Tax Rates (2023 Guide) – Forbes Advisor

Payroll Tax Definition, What are Payroll Taxes?, TaxEDU

What are the major federal payroll taxes, and how much money do

FICA Tax: What It is and How to Calculate It

What Is FICA Tax? A Complete Guide for Small Businesses

2021 Wage Base Rises for Social Security Payroll Taxes

What Is FICA on a Paycheck? FICA Tax Explained - Chime

Overview of FICA Tax- Medicare & Social Security

Social Security wage base is $160,200 in 2023, meaning more FICA

Why do FICA-SS and FICA-MC show as ZEROS on my Tax Deposit and 941

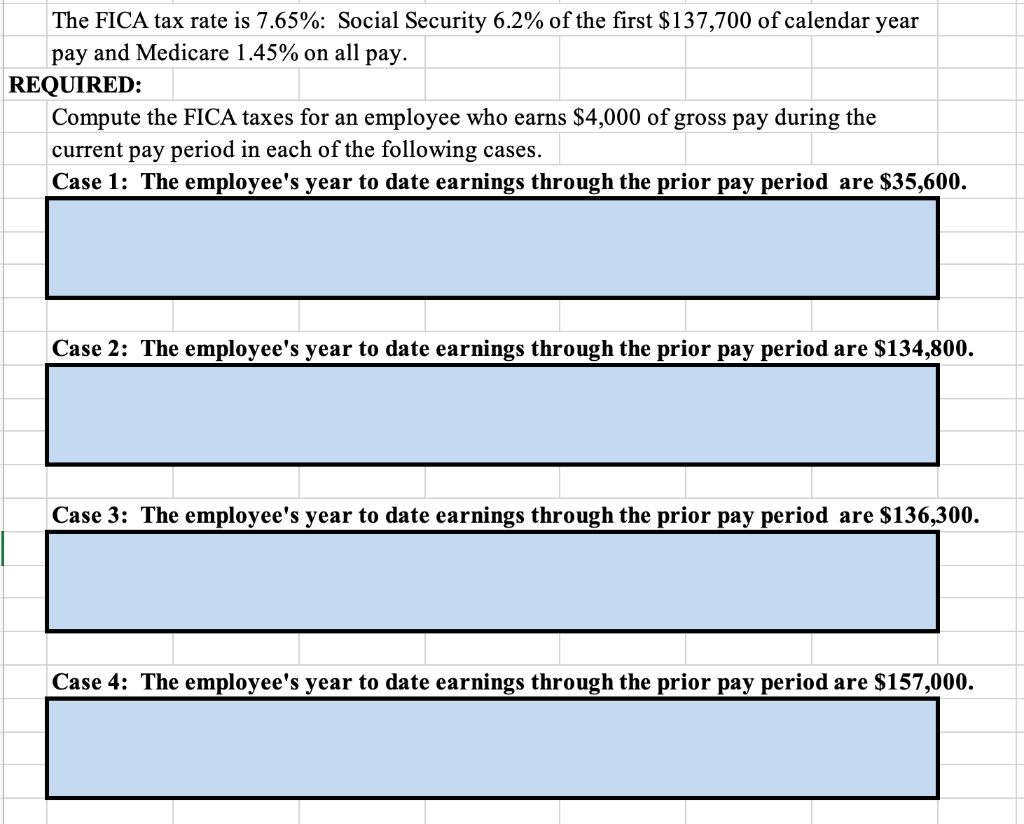

Solved The FICA tax rate is 7.65%: Social Security 6.2% of

Recomendado para você

-

What is FICA tax?08 novembro 2024

What is FICA tax?08 novembro 2024 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand08 novembro 2024

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand08 novembro 2024 -

What are FICA Tax Payable? – SuperfastCPA CPA Review08 novembro 2024

What are FICA Tax Payable? – SuperfastCPA CPA Review08 novembro 2024 -

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet08 novembro 2024

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet08 novembro 2024 -

What Is FICA Tax?08 novembro 2024

What Is FICA Tax?08 novembro 2024 -

FICA explained: Social Security and Medicare tax rates to know in 202308 novembro 2024

FICA explained: Social Security and Medicare tax rates to know in 202308 novembro 2024 -

What Eliminating FICA Tax Means for Your Retirement08 novembro 2024

-

FICA Tax - An Explanation - RMS Accounting08 novembro 2024

FICA Tax - An Explanation - RMS Accounting08 novembro 2024 -

FICA Tax Tip Fairness Pro Beauty Association08 novembro 2024

FICA Tax Tip Fairness Pro Beauty Association08 novembro 2024 -

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?08 novembro 2024

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?08 novembro 2024

você pode gostar

-

Call of Duty: Vanguard Reveals Inglourious-Basterds-Flavored Multiplayer, New Warzone Map08 novembro 2024

Call of Duty: Vanguard Reveals Inglourious-Basterds-Flavored Multiplayer, New Warzone Map08 novembro 2024 -

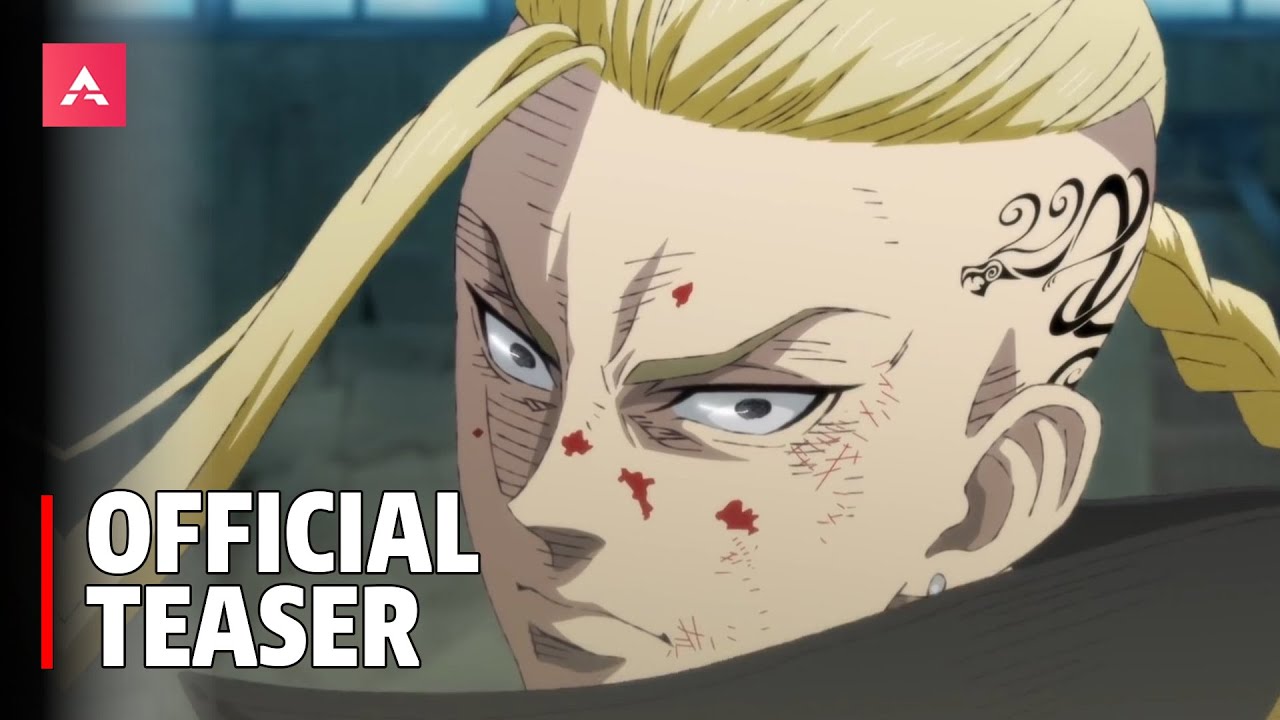

Tokyo Revengers Season 2 - Official Announcement Teaser Trailer08 novembro 2024

Tokyo Revengers Season 2 - Official Announcement Teaser Trailer08 novembro 2024 -

/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2020/H/F/wTQCYsSRGsiIvjGgAXXQ/print-2020-03-19-10-10-33-zy14f.jpg) Google Tradutor libera recurso de tradução instantânea; saiba usar08 novembro 2024

Google Tradutor libera recurso de tradução instantânea; saiba usar08 novembro 2024 -

One Piece - Episode of Luffy: Adventure on Hand Island (Film) ~ All Region ~ DVD08 novembro 2024

One Piece - Episode of Luffy: Adventure on Hand Island (Film) ~ All Region ~ DVD08 novembro 2024 -

Bandit Mtg GIF - Bandit Mtg Objectif Mythique - Discover & Share GIFs08 novembro 2024

Bandit Mtg GIF - Bandit Mtg Objectif Mythique - Discover & Share GIFs08 novembro 2024 -

Pluto Tv Boruto Ep 53 Dublado08 novembro 2024

-

Lucky Block Maps for MCPE - Apps on Google Play08 novembro 2024

-

QUEEN - Flash Gordon (Original Soundtrack) - Music08 novembro 2024

QUEEN - Flash Gordon (Original Soundtrack) - Music08 novembro 2024 -

Mag Hank / The protagonist / From:Madness combat / Minecraft Texture Pack08 novembro 2024

Mag Hank / The protagonist / From:Madness combat / Minecraft Texture Pack08 novembro 2024 -

Little Nightmares will bring its dark adventure gameplay to mobile08 novembro 2024

Little Nightmares will bring its dark adventure gameplay to mobile08 novembro 2024